Author | He Zhexin

Edit | Dong Jie

If you type “H & M” on the search engine, you will find that the official website address logo of different regions is slightly different.

In the title of the official website of Higong and Taiwan, the “optimal price” is in front of “fashion” and “quality”; the English official website also emphasizes At Best Price.However, the mainland official website adjusts the order of three keywords slightly: fashion and quality are ranked first and second, and the “reasonable price” is at the end.

This is in line with a new image that fast fashion brands such as ZARA and Uniqlo, including ZARA, Uniqlo, and other fast fashion brands: abandon the label of seasonal large discounts and emphasize quality and fashion characteristics.The weathervane meaning.

Save H & M’s performance to a certain extent.

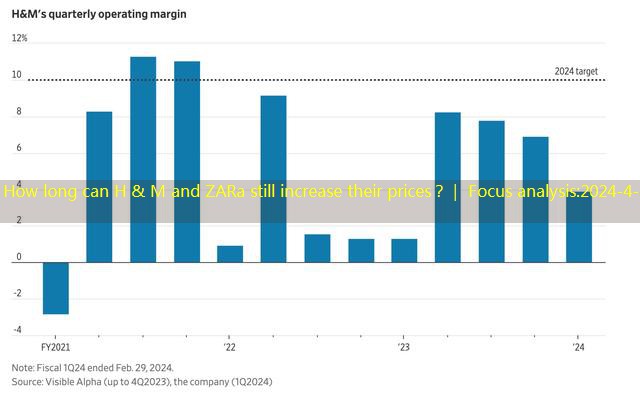

superiorIn the first quarter of 2024, although sales fell slightly by 2%, H & M’s operating profit rose to 2.08 billion Swedish Crown (approximately 1.4 billion yuan), with a profit margin of 4%, a higher expected 2.2%EssenceThe cost control strategy, including discount amplitude, has played an important role.

At the financial report, CEO Daniel Erver stated that it would maintain the annual goal of “10%operating profit margin”. Last year, the number was 6.2%.”Our gross profit margin performed well, and cost control is also good, but to achieve the goal, we need to see more sales numbers.”

The meritorious meritorious meritoriously in H & M, who had no warning in January this year, was appointed by the outside world as the savior of this Swedish fast fashion giant to turn the tide.

H & M quarterly profit margin comparison | Source: company financial report

But unlike H & M, another high -end fashion giant ZARA’s high -end road goes well.In the past year,ZARA’s revenue and profits have not decreased, showing stronger pressure resistance.

Logistics cost is an important factor.ZARA’s purchasing is more distributed in Eastern Europe and Central America, close to the main European and American markets, which can not only respond faster the trend of fashion changes, “the new product listing speed is about twice a week”, and the logistics cost is relatively low.It is reported that Zara’s parent company Inditex’s annual investment in logistics improvement has reached 900 million euros.For elastic pricing in different regions, it can also balance ZARA’s income -these are the reasons why it still maintains a healthy growth momentum in the downward cycle.

In contrast, H & M is not large.In the past, the supply chain of H & M was mainly in China. This model that rely on single market production, although significantly reduced the cost of supply chain, is not conducive to global sales of H & M products.Some analysts said that H & M is considering reducing the single dependence of production, and more factories are built in Europe and America to further save costs.

However, if you want to “open source”, H & M needs to properly reduce the frequency of discounts on the basis of maintaining the “20-30 young women” customer base, which will be a more difficult challenge.

Earlier RBC analysts pointed out that the price of H & M in the UK was 10%lower than the original price, and the discount rate of H & M was about 20%before.ZARA also has similar figures. In 2024, the average cost of clothing in Zara’s spring clothing was 11%higher than two years ago.In Shanghai with the largest number of ZARA stores, some consumers expressed their obvious feelings to 36 氪 that “the price of new products in spring and summer is higher than the past.”

Unlike ZARA’s firm price increase, H & M had some ambiguous attitudes after publishing financial reports. Perhaps the senior management has realized that the continued price increase will bring a counterproductive effect.H & M Greater China has been lacking in sales in the past quarter.

However, the problem is that when these methods gradually become daily, the physical sensation of “getting more and more expensive” has become a consumer consensus. Can the old and fast -fashioned veterans continue to make good performance reports?

In China, the biggest obstacles of fast fashion price increase (or maintaining the original price) come from increasingly more and more high -quality, lower -priced domestic “replacement”.

For a long time in the past, fast fashion brands have been opened with the so -called “original order” and “tail order” attitude.The price of the version and 1/10 is put on the shelf. It is not difficult to pick up a coat that can be recruited when you are lucky.Yu Yemian.

In February this year, for the first time, the “dumpling bag” tasted Uniqlo, which led the fashion taste, chose to play a heavy punch, claimed 160 million yen to Shein, and asked to stop selling imitations of “round mini -shoulder bags”.CICC’s research report once said that SHEIN has now undertakes the production capacity of some small and medium -sized factories in China, and “nearly one -third of Chinese clothing supply companies are also supplied to SHEIN”, thus forming a positive confrontation with fast fashion giants.

Although SHEIN stated that “seriously treat all infringement allegations” and stated that it invested a lot of funds on the system of copyright infringement in the supply chain, and launched the “SHEIN X” designer incubation project in 2021, and in September 2023Adding capital injection to the project.

In addition to litigation with the platform, there are enough fast fashion groups in hand to resurrect some cheaper sub -brands to cope with the rise of very fast fashion “replacement”.

In January of this year, the H & M Group announced the return of the Zip Monday of the Zizi brand, and brands, including Weekday and Monki, are also returning to the plan.Cheap Monday is dominated by denim products, rebellious style, aiming at the young market, and was acquired by H & M in 2008. He was shut down in 2018 due to poor long -term performance.

Inditex announced last month to restart the Lefties of the Zara Ole Line brand, which has now expanded to 17 countries, including Turkey, Egypt, Romania, Mexico, UAE, etc., and most of them are located in the Middle East and Africa.Among them, 7 countries have also opened Lefties physical stores.Some analysts believe that sooner or later Lefties will be split into independent brands and calculate performance alone.

However, the above -mentioned “resurrected” sub -brands have not planned to enter China for the time being, which also means that in the foreseeable future, at least in the Chinese market, high -end will continue to become the route of H & M and Zara.Specific measures include the launch of more designer joint -name and opening more stylish large shops.